Industrial a house finance are used to buy otherwise redesign industrial assets. Normally, lenders wanted advertisers in order to occupy at least more than half of the property in order to qualify for such mortgage.

Charge factoring

That have invoice factoring, also referred to as profile receivable resource, your promote your own the customers statements to a great factoring team in the an economy. The fresh new factoring providers will give you a percentage (state ninety%) of the total the count and then collect percentage straight from your prospects. Just after it’s compiled commission from your own people, the new factoring organization will discharge all of those other financing to you, without a beneficial factoring fee.

Devices financing

Devices finance is commercial funds where you can pick or book the device need in place of getting any money initial. These loans additionally use the equipment by itself just like the security; if you cannot pay off the borrowed funds, the lending company often grab their devices.

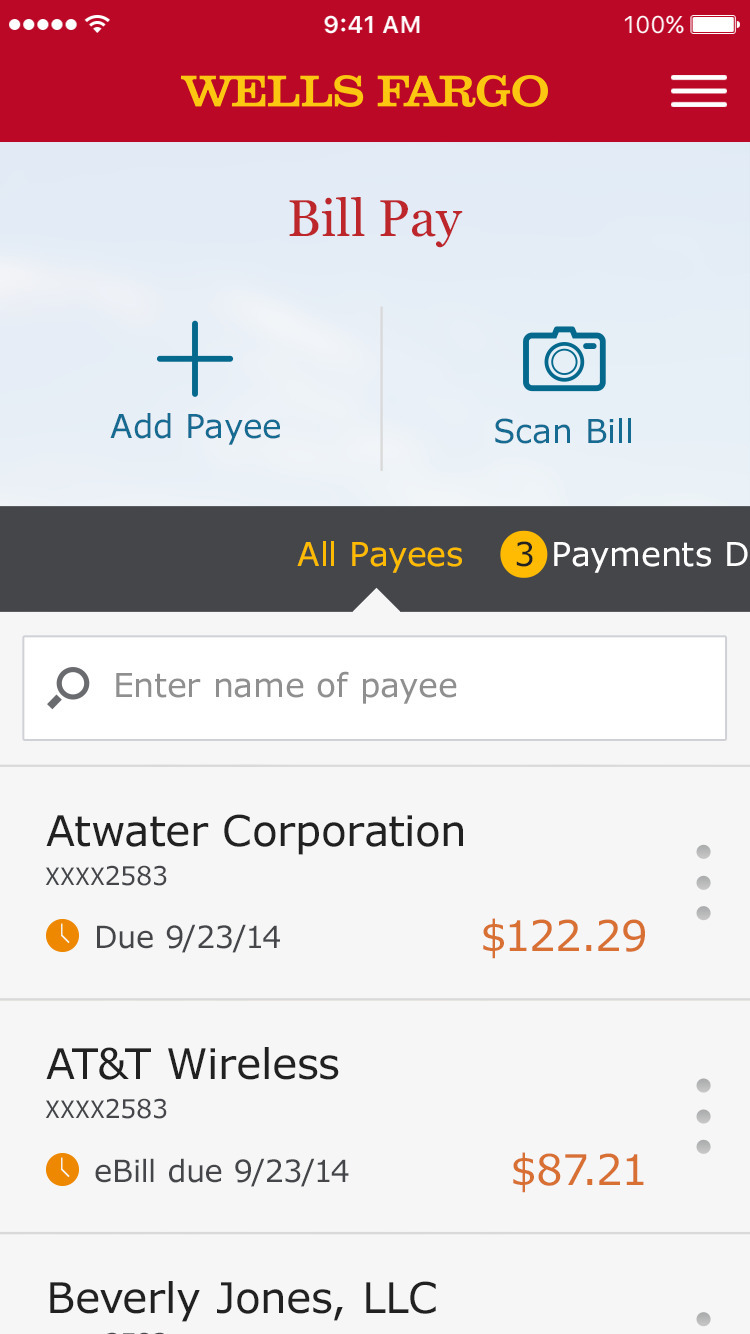

Company credit lines

Team lines of credit is actually revolving fund, meaning that extra cash getting online because you pay everything borrow – just like credit cards. You have to pay focus on which you use, and costs are arranged day-after-day, each week, otherwise monthly.

Name loans

Label financing are disbursed once the swelling figures and you will repaid more an effective preset several months, also known as name. Label finance may have repaired otherwise varying rates of interest and fees regards to doing five years.

Seller payday loans

A seller pay day loan enables you to rating a lump sum payment matter in return for a percentage of your own upcoming credit and you may debit credit transformation. You should buy exact same-big date financing having a provider payday loan,  that renders that it a beneficial option for problems. But not, MCA cost could be extremely large and you can money must be generated each and every day or a week.

that renders that it a beneficial option for problems. But not, MCA cost could be extremely large and you can money must be generated each and every day or a week.

Business funds

Business fund allow you to get upfront investment to cover business charges, court costs, a property will set you back or any other time-to-go out expenses regarding as good franchisee.

SBA fund and just how they work

The fresh new SBA backs old-fashioned bank loans to have small businesses by the level area of the loan in the event your debtor non-payments. Since there is faster exposure to own loan providers, cost getting SBA-recognized finance be much more aggressive and may even function top terms and conditions.

Such as, for the Covid-19 pandemic, the brand new SBA lengthened plenty of rescue software to simply help brief entrepreneurs impacted by the drama, along with deferment of dominating and you may attention payments for disaster loans.

It is critical to observe that the newest SBA doesn’t provide currency straight to smaller businesses except if he or she is located in a declared emergency urban area. As an alternative, the newest SBA kits lending assistance towards the lenders they partners that have, including banking companies, area teams and you will microlenders.

Difference in SBA fund or any other small business finance

Small company funds secured by SBA enjoys reduce money, versatile requirements and you may, in many cases, do not require collateral. Yet not, it may take as much as 90 days on how best to discovered an SBA-backed loan.

The new SBA promises money for amounts ranging from $30,one hundred thousand and you will $5 million, that have annual fee costs anywhere between 5.5% to eight%. He or she is best suited for very long-label investments, to invest in a house otherwise gizmos, buying others and you can refinancing established financing.

Version of SBA fund

SBA 7(a) loans: The most used version of home business loan. These loans might be best designed for a house acquisition, yet could also be used getting brief- and you can much time-title working capital, furniture and you can offers, purchase and you will expansion.

Real estate and you may Products fund (CDC/504): Promote repaired-speed investment all the way to $5 billion to promote organization growth and employment creativity. Such money can be used to purchase land, build business, see devices and loans home improvements. They are certainly not used due to the fact working capital, to pay or refinance loans, for opportunities or even for rental services.